CUMMINS INC.

500 JACKSON STREET, BOX 3005, COLUMBUS, INDIANA 47202-3005

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

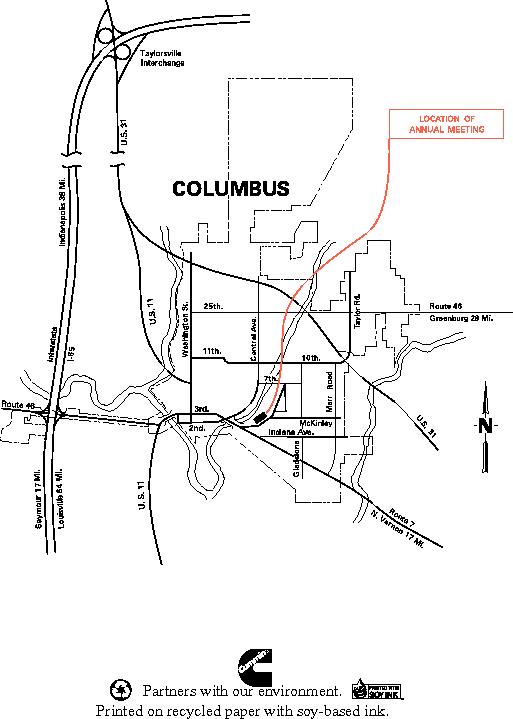

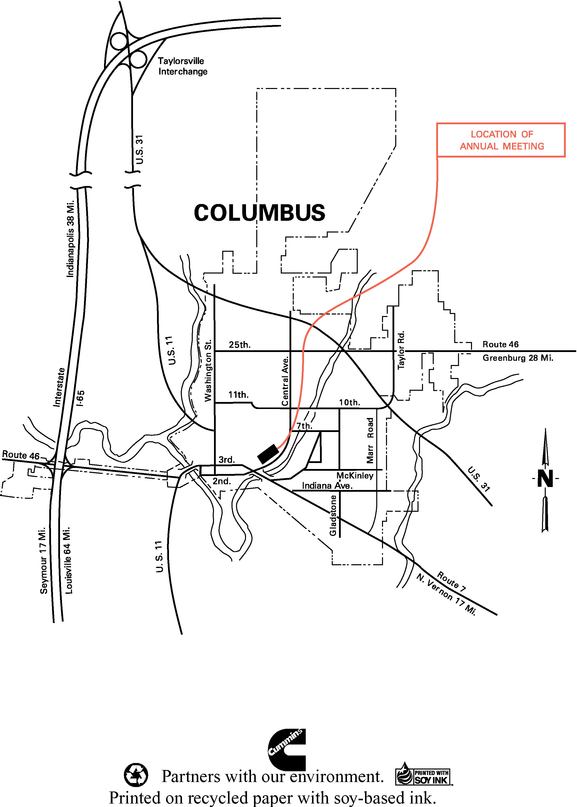

NOTICE IS HEREBY GIVEN that the Annual Meeting of the Shareholders of Cummins Inc. will be held at the Company’s Technical CenterCompany's Columbus Engine Plant located at 1900 McKinley500 Central Avenue, Columbus, Indiana, on Tuesday, May 9, 2006,13, 2008, at 11:00 a.m., local time, Eastern Daylight Savings Time, for the following purposes:

2008;

Only shareholders of Common Stock of the Company of record at the close of business on March 20, 200624, 2008 are entitled to notice of and to vote at the meeting.

Shareholders of Common Stock who do not expect to be present in person at the meeting are urged to vote their shares by telephone, via the Internet, or by completing, signing and dating the enclosed proxy and returning it promptly in the envelope provided.

The proxy may be revoked by the shareholder giving it at any time before the voting. Except with respect to shares attributable to accounts held in the Cummins Inc. and Affiliates Retirement and Savings Plans, any shareholders entitled to vote at the meeting who attend the meeting will be entitled to cast their votes in person.

| MARYA M. ROSE, | Secretary | ||

| April 3, 2008 |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD

ON MAY 13, 2008: the Annual Report and Proxy Statement

are available at www.ematerials.com/cmi

April 7, 2006

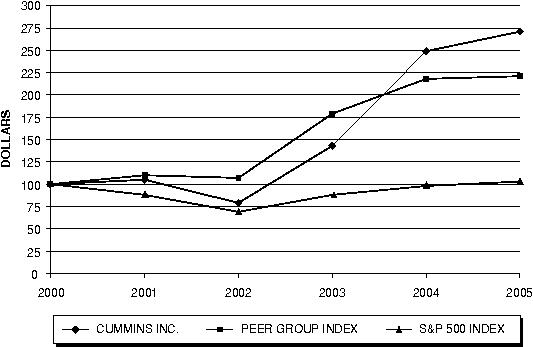

CUMMINS INC. 500 JACKSON STREET, BOX 3005, COLUMBUS, INDIANA 47202-3005 This proxy statement is being furnished in connection with the solicitation by the Board of Directors of Cummins Inc. (the Holders of the Each share of Common Stock represented by a properly executed proxy will be voted at the Annual Meeting in accordance with the instructions indicated on that proxy, unless such proxy has been previously revoked. If no instructions are indicated on a signed proxy, the shares represented by such proxy will be voted as recommended by the Board of Directors. A shareholder may revoke the proxy at any time before it is voted by delivering to the Secretary of the Company written notice of such revocation. This notice must include the number of shares for which the proxy had been given and the name of the shareholder of such shares as it appears on the stock certificate(s), or in book entry form on the records of the Company's stock transfer agent and registrar, Wells Fargo Shareowner Services, evidencing ownership of such shares. In addition, except with respect to shares attributable to accounts held in the Cummins Inc. and Affiliates Retirement and Savings Plans, any shareholder who has executed a proxy but is present at the Annual Meeting will be entitled to cast The following table identifies those shareholders known to the Company to be the beneficial owners of more than five percent of the Common Stock of the Company and shows as to each such shareholder as of December 31, Amount and Nature Percent of Class State Street Bank and Trust Company 6,318,806 (1) 14.19 % Barclays Global Investors N/A 4,984,629 (2) 11.19 % Lord, Abbett & Co. 3,059,748 (3) 6.87 % FMR Corporation 2,615,281 (4) 5.87 % LVS Asset Management 2,447,732 (5) 5.50 % Capital Research and Management Company 2,413,190 (6) 5.42 % Nominee Robert K. Herdman was elected by the Board of Directors on February 12, 2008 upon recommendation of its Governance and Nominating Committee to serve as a director until the Annual Meeting. Mr. Herdman was recommended by the Committee and elected by the Board following a review of his qualifications under the standards of the Company's Corporate Governance Principles referenced on page 7 of this Proxy Statement and a review of his independence. The Corporate Governance Principles are available on the Company's website http://www.cummins.com and are otherwise available in print to any shareholder who requests them. Effective last year, the Company changed the method by which directors are elected by amending its By-Laws. The changed procedures apply to an uncontested election, which is one in which the number of nominees does not exceed the number of directors to be elected. In an uncontested election, any nominee who does not receive a majority of the share votes cast shall promptly offer his or her resignation to the Board following certification of the shareholder vote. A vote of the majority of share votes cast means that the number of shares voted "for" exceeds the number of votes "against" that director. Under the amended By-Laws, abstentions and broker non-votes are not counted as a vote "for" or "against" a director. The Governance and Nominating Committee of the Board of Directors will promptly consider the resignation offer and make a recommendation to the Board. The Board will act on the Governance and Nominating Committee's recommendation within 90 days following certification of the shareholder vote. Thereafter, the Board will promptly disclose its decision whether to accept the director's resignation offer. The director who tenders his or her resignation pursuant to this provision will not participate in the Governance and Nominating Committee's recommendation or Board decision whether to accept his or her resignation offer. The Board of Directors The names of the nominees for directors, together with certain information regarding them, are set forth in the following table. Biographical sketches of these nominees, which include their business experience during the past five years and directorships of other corporations, are provided on pages Name and Occupation Age First Year Amount and Percent Stock Units Total Robert J. Darnall 68 1989 7,927 * 3,379 11,306 Retired Chairman and Chief Executive Officer of Inland Steel Industries, basic steel manufacturer, processor and distributor John M. Deutch 68 1997 9,679 (3) * 0 9,679 Institute Professor, Massachusetts Institute of Technology Alexis M. Herman 58 2001 4,437 * 0 4,437 Chairman and Chief Executive Officer of New Ventures, independent consulting firm F. Joseph Loughrey 56 2005 79,388 * 0 79,388 President and Chief Operating Officer of Cummins William I. Miller 49 1989 30,036 * 842 30,878 Chairman and Chief Executive Officer of Irwin Financial Corporation, financial services company Georgia R. Nelson 56 2004 1,483 * 0 1,483 President and Chief Executive Officer of PTI Resources, LLC, independent consulting firm Theodore M. Solso 59 1994 168,797 (4) * 0 168,797 Chairman and Chief Executive Officer of Cummins Carl Ware 62 2004 1,363 * 0 1,363 Retired Executive Vice President, Public Affairs and Administration, The Coca-Cola Company J. Lawrence Wilson 70 1990 20,024 * 3,589 23,613 Retired Chairman and Chief Executive Officer, Rohm and Haas Company, specialty chemical manufacturing 9. The Company has long believed that good corporate governance is important in ensuring that it is managed for the long-term benefit of its shareholders. It continuously reviews the Independence The Board is composed of a majority of directors who qualify as independent directors In determining independence, each year the Board affirmatively determines whether directors have no Board of Directors and Committees The Board of Directors held Under the Company's stakeholders. The functions performed by certain of these committees and the members of the Board of Directors currently serving on these committees are as follows: Audit Committee. The members of the Audit Committee are R. J. Darnall (Chairman), A. M. Herman, G. R. Nelson, C. Ware and J. L. Wilson. All members are Independent Directors. The Board of Directors has determined that Mr. Darnall and Mr. Wilson are and procedures of the Company. The Audit Committee reviews the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent public accountants, including their recommendations to improve the system of accounting and internal controls. It also monitors the independence and performance of the external and internal auditors. The Audit Committee met Compensation Committee. The members of the Compensation Committee are A. M. Herman (Chairman), R. J. Darnall, G. R. Nelson and J. L. Wilson. All members are Independent Directors. The Compensation Committee administers and determines eligibility for, and makes awards under, the The Committee maintains a formal process to ensure the independence of the input received from executive compensation consultants with the following stipulations regarding any engagements the Committee enters into with executive compensation consultants. The Committee: The Compensation Committee met Governance and Nominating Committee. The members of the Governance and Nominating Committee are J. and makes recommendations to the Board with respect to membership, size, composition, procedures and organization of the Board of Directors. The Committee uses its network of contacts to identify potential As required by the Corporate Governance Principles, the Committee must recommend directors such that the Board is comprised of a majority of Committee members The Governance and Nominating Committee met Executive Committee. The members of the Executive Committee are T. M. Solso (Chairman), W. I. Miller and J. L. Wilson. The Executive Committee is authorized to exercise the powers of the Board of Directors in the management and direction of the business and affairs of the Company during the intervals between meetings of the Board of Directors. It also acts upon matters specifically delegated to it by the full Board of Directors. The Executive Committee did not meet during Other Committees. In addition to the Committees described above, the Board of Directors has established the following committees: Finance Committee (W. I. Miller (Chairman), R. J. Darnall, J. M. Deutch, C. Ware and J. L. Wilson); Proxy Committee Communication with the Board of Directors.Shareholders and other interested parties may communicate with the Board of Directors, including the Lead Director and other non-management directors, by sending written communication to the directors c/o the The Secretary shall maintain and provide copies of all such communications, received and determined to be forwarded, to the Governance and Nominating Committee in advance of each of its meetings and report to the Committee on the number and nature of communications that were not determined to be forwarded. The Company has a practice of requiring all directors standing for election at an Annual Meeting of Shareholders to attend such meeting. All The table on the following page sets forth information regarding the directors' compensation during the Company's last completed fiscal year. Each director who As part of the The Company has a Each non-employee director will be required to maintain direct ownership of shares of Common Stock equal to or greater in value to three (3) times his or her annual retainer fee. This ownership requirement must be achieved by 2010 for directors who were first elected prior to 2004. Directors first elected after 2003 must comply with the requirement within six (6) years of becoming a member of the Board. When future accruals under a retirement plan for non-employee directors were terminated several years ago, directors with vested benefits were given an option to have their accrued benefits retained in the plan for future payment or to convert the present value (using the same actuarial assumptions as are applicable to the payment of pension benefits to the dividend equivalents, are evidenced by bookkeeping entries. Recipients have no voting or investment power with respect to the stock units. The value of each (3) These amounts represent "Above Market" earnings in the Deferred Compensation Plan, as described above. "Above-market" is defined as the amount of earnings that exceeded 120% of the In addition, premiums totaling $44,640 were paid on life insurance policies in connection with Mr. Deutch's participation in the Cummins Inc. Charitable Bequest Program, as described above. Policies for all other non-employee directors who Objectives and Principles of Cummins Executive Compensation Program The Company is committed to the concept of pay for sustained In addition to pay for performance the Achieving the Performance-Based Principle Our program strongly supports pay for performance. The more senior the position, the more pay should be "at risk", dependent on Company performance. To illustrate how the program achieves these objectives, following are the percentages for each of the three elements that make up target total direct compensation opportunity provided to the CEO and the other Named Executive Officers in 2007 (excluding benefits and perquisites). Overview of How Compensation is Determined Senior Management (the management Executive Committee) recommends compensation actions to the CEO for officers in the areas for which they are responsible. Taking these recommendations into consideration, the CEO makes recommendations to the Compensation Committee regarding each officer (including members of the Executive Committee). These recommendations are based on assessments of individual performance and potential to assume greater responsibility, as well as market data for each position. The CEO discusses the recommendations and performance of the officers with the Committee. As part of its review process, the Committee has access to input of an independent consultant, Hewitt Associates, retained by the Committee (the role of the independent consultant is described in more detail in the "Corporate Governance" section of this proxy). The Committee reviews the recommendations, may make modifications, and makes the final decisions regarding each officer's compensation. The CEO, on an annual basis, discusses in detail his priorities and objectives with the Governance and Nominating Committee (the members and responsibilities of the Governance and Nominating Committee are described beginning on page 6 of this Proxy Statement). The Governance and Nominating Committee formally reviews the CEO's performance annually. This review is based on how well the CEO performed against specific objectives, which includes the progress made by the Company in implementing its business strategy and achieving its business objectives, both short-term and long-term. This review, which is reported in detail to the Compensation Committee, considers both quantitative and qualitative performance matters and is a key factor in setting the CEO's compensation. Specific business objectives and goals that were part of the CEO's performance review for 2007 include the financial performance of the Company, progress towards achieving the Company's long-term strategic objectives and the development of key leadership talent. The Committee meets in executive session to determine the compensation of the CEO. In this discussion, the Committee has access to data and advice from its Consultant. No recommendations are made by any members of management regarding the compensation of the CEO. The Committee makes the final decisions regarding the CEO's compensation. The Committee regularly reviews all elements of the executive compensation program and makes changes it deems appropriate. The reviews include comparisons against a broad group of U.S. manufacturing companies prepared by the Consultant, including selected market practices, for the following: The Committee has determined that if any of the Company's financial statements are required to be materially restated resulting from the fraudulent actions of an officer, the Committee may direct that the Company recover all or a portion of an Award or any past or future compensation from any such officer with respect to any fiscal year of the Company for which the Company's financial results are adversely affected by such restatement. Tax Considerations Section 162(m) of the Internal Revenue Code Therefore, that portion of the CEO's Base Salary that exceeded one million dollars in 2007 will not qualify for tax deductibility under Section 162(m). As The Each of our officer positions is compared to the same job using regression analysis to calculate median levels of Base Salary, target Annual Bonus participation and Longer-term grant target value for the scope of responsibility for each of our positions among U.S. manufacturing companies in the Consultant's survey database. The one hundred seventy-eight U.S. manufacturing companies in the database cross nineteen industry classifications and have annual sales volumes ranging from $350 million to $207 billion, with average sales of $13.8 billion. The Company and the Committee believe that the broader survey base of major U.S. manufacturing companies provides a reasonable and more useful measure of market compensation and allows more consistent year-to-year market comparison than would a smaller peer group of companies. The survey's statistical tools calculate market compensation for the specific levels of responsibility for each position. For example, the total sales of the Company are used to calculate the market median compensation levels for officers who have responsibility for the Corporation; the sales volume for an operating segment would be used for officers responsible for that business. As stated earlier, the CEO makes compensation recommendations to the Committee in its February meeting for each officer, including the Named Executive Officers, excluding himself. The recommendations are based on individual performance and potential to assume greater responsibility, as well as market data for each position. The Committee makes the final compensation determinations based on the market data and a discussion of individual and Company performance. The officer compensation review occurs annually at the February Compensation Committee meeting since this is the first Committee meeting after year-end and provides the earliest opportunity to review and assess performance for the previous year. During the February meeting, the Committee also meets in executive session to determine compensation for the CEO based on performance assessment and market data. Each element of pay described below is intended to provide total compensation for each position at the median of the amounts companies of similar size in the survey would pay the same position. 1. Base Salary Base Salary is reviewed Individual performance, assessments of each officer's capability to assume larger roles and market data for each position are prime factors considered by the Committee each year in determining the amount of Base Salary increase, if any, to be provided. 2. Annual Bonus This element is designed to link executive pay to the annual performance of the Company. The Payout Factor is calculated based on a formula ROANA is calculated as follows: The numerator is Segment EBIT, which for compensation purposes is defined as Payout Factors are determined using actual ROANA measures compared to plan target ranges. The Annual Bonus is calculated as For example: Participation rates are based on the same survey data as base salaries and are set at the median of the range for like positions in similarly-sized companies. The participation rates for 2007, expressed as a percentage of Base Salary paid, were: For officers working outside the corporate staff, 50% of their Annual Bonus is based upon the performance of their specific operating unit and 50% of the bonus is based upon the consolidated Corporate Plan. The definition of performance is the same for both the operating and corporate elements of the plans. We believe that the measure of performance needs to balance both profit and stewardship of the Company's assets. As such, we use a defined ROANA measure as described above on which to determine the payout factors in the operating plans. In setting the financial targets for the Annual Bonus each year, the Committee reviews the levels of difficulty of the operating plan for each unit, considering the markets involved and the current economic environment. The Committee then establishes appropriate stretch targets to receive a 1.0 payout. The consolidated Company (Corporate) performance is the weighted average payout of the operating unit measures. Setting the targets with appropriate levels of difficulty underscores the importance of achieving or exceeding the performance commitments each operating segment establishes annually. This approach requires increasingly difficult targets during economic upturns, and realistic goals that maximize performance during cyclical downturns. As evidence of the difficulty of the targets, over the last ten years the 1.0 target level has been achieved or exceeded 50% of the time. The Annual Bonuses for T. M. Solso, F. J. Loughrey, and J. S. Blackwell were based on the Corporate weighted average formula. The Annual Bonuses for T. Linebarger and J. D. Kelly were based one-half on the Corporate weighted average formula and one-half on the performance of the Power Generation Operating Segment for Mr. Linebarger and one-half on the performance of the Engine Operating Segment for Mr. Kelly. The Payout Factor for the The Committee has the flexibility to establish performance measures annually that are appropriate for the Company's financial goals, underscoring the principle of pay for performance. The Committee also determines certain exclusions from operating performance measures which result from decisions made at the Corporate level, such as acquisitions, divestitures, or joint venture formations in the initial year if they were not anticipated at the time targets were established, pension plan contributions above required levels, and convertible debt. Certain Corporate expense allocations are also excluded from the individual operating unit performance calculations. In 2007, the ROANA calculations excluded the impact of assets and liabilities associated with corporate hedging programs, pension contributions above required levels and the impact of acquisitions or divestitures not contemplated at the time the performance measures were established. By achieving performance approximately 16% greater than the target levels, the Payout Factor for each of the Named Executive Officers varied between 1.9 and 2.0. The Components Group Segment ROANA represents the weighted average performance targets for the businesses within that segment. Performance targets established for the Annual Bonus Plan for 2008 are well within the targeted ranges for the Company, In order to earn a 1.0 target Payout Factor for 2007, the targets set in the operating plan would have required a level of earnings before interest and taxes ("EBIT") as a percentage of Sales greater than achieved in nine out of the last ten years of the Company's performance, while prudently managing the Company's assets (EBIT is the numerator in calculating the ROANA performance measure). The Payout Factors are capped at 2.0. Performance required for the maximum payouts in 2007 represent levels that significantly exceed the target levels, 16% greater than the 1.0 level cumulatively. The threshold payout of .1 (10% of the Target Payout) would have required performance that was In addition to the In order to comply with the requirements of Section Bonus Plan called the Senior Executive Bonus Plan. The Senior Executive Bonus Plan differs from the Annual Bonus Plan in The Performance cash awards are granted as Target Awards expressed as a dollar amount for each participant. Multiples of the Target Award are earned and paid in cash, ranging from zero to two times the Target Award, based on how well the Company achieves performance measures established by the Committee over a specified measurement period. Performance cash awards are granted under the The Target Award will be paid if the Company achieves the level of Return on Equity provided by achieving a target set based on (a) the agreed target level for the second year of the Award Cycle, measured cumulatively for the two-year period. The ROE for each Award Cycle is calculated as the cumulative Net Income for the two-year period divided by the Average Equity for the two-year period, divided by two. The Average Equity for the two-year award cycles is calculated using nine points: the beginning of the first year of the Award Cycle and each of the eight quarter-ending values. The numerator is Profit after Tax (PAT) for the two-year period. The equity calculation is adjusted for changes to equity related to unrecognized Pension and Other Post Employment Benefit (OPEB) amounts and equity transactions not built into the Operating Plan such as Common Stock share repurchases. The degree of difficulty for achieving the Annual Operating Plan was discussed in the Annual Bonus discussion. As an indication of the difficulty of the targets, the Payout Factors have averaged .785 over the last ten years. The performance cash payouts made in 2007 were for the 2005 - 2006 Award Cycle. A 2.0 Payout Factor for that Award Cycle required performance equal to 139% of the target performance level. The Target Award was set at 18% ROE. Actual performance for 2005 - 2006 was 26.0% ROE. For the 2007 - 2008 Award Cycle, with payout in 2009, the Target Award requires an ROE of 17.87% for the two-year period, reflecting the impact of U.S. emissions regulations changes in 2007. The maximum that can be paid is 200% of the Target Award for performance that As is the case with respect to the Annual Bonus Plan, In 2003 shareholders approved the 2003 Stock Incentive The Target Award of performance shares granted to each participant in Officers are prohibited from engaging in forms of hedging or monetization transactions involving the establishment of a short position in the Company's securities, such as zero-cost collars and forward sale contracts. Longer-term Grant Methodology Longer-term grants have been made at the February meetings since 1997. The practice has been to make compensation decisions at the earliest Compensation Committee meeting after the end of the year, based on assessments of each officer's performance and ability to assume additional responsibility, and a review of market data for each position. When stock options were components of the Longer-term grants (prior to 2004), they were priced as the average of the High and Low trading price of the Company's stock on the date the Committee made the grants at their February meeting. The regular annual grant date removed any subjectivity regarding the current market price of the Company's stock during the period when stock options were part of the grants. In determining the appropriate market levels for Longer-term grants, the Company uses a valuation methodology developed by the Consultant to compare the value of the grants to the market. This method calculates a present value for the performance cash and performance shares. A six-month average price of the Company's stock is used in calculating the present value of the performance shares for market comparisons. The projected value of the Longer-term grants is evenly divided between performance cash and performance shares, each providing one-half. Grant amounts under the Committee reviews the proportion of total compensation that is dependent on Company performance in determining the allocation of the compensation opportunity among each of the ROE has been the measure on which Longer-term grants are earned because we believe that it provides a measure of profitability relative to the shareholder's stake in the Company over the performance period, and historical data have indicated a strong, positive correlation between ROE and Stock Price growth at the Company. We believe that the performance shares forge a strong linkage of interests between management and shareholders since the value participants actually receive is determined by both performance relative to the pre-established financial goal, as well as our stock price. We believe that a two-year performance measurement period provides the ability to set targets that are focused and more accurately planned than could be done for longer timeframes. Furthermore, the additional year of restriction for earned performance shares beyond the two-year performance period provides a longer retention time-frame for the participants, and ensures continued focus on stock price growth for that period. Stock Ownership Requirements The The ownership requirements Officers have five years from the date of their appointments to All of the Named Executive Officers have met their stock ownership requirement. We also adopted formal stock ownership guidelines for members of the Board of Benefits and Perquisites same plans as other exempt employees. The In addition to these benefits, the Company's officers participate in the Supplemental Life Insurance and Deferred Income Program. The program is provided to attract and retain key leadership talent in senior positions. This program provides additional life insurance equal to three times base salary while the officer is an active employee, and additional retirement payments, which are offset by and coordinate with payments from the Company's regular retirement plans. The supplemental retirement provision "tops up" the pension available from the Company's regular pension plans to provide a total benefit based on a percentage of the officer's highest average consecutive sixty-month (five years) Base Salary and Annual Bonus The Company's officers, including the Named Executive Officers, are eligible to participate in the Company's non-qualified Deferred Compensation Plan, as are all exempt U.S. employees whose salaries equal or exceed $100,000. This program is designed to provide opportunities for capital accumulation and financial planning, and to meet competitive market practice. Perquisites do not comprise a major element in our Executive Compensation Program. The Company provides support for the services of a financial counselor. The financial counselor provides estate planning and tax planning advice and tax return preparation. The fee amounts for these services are detailed in the Summary Compensation Table. This program assists executives in making prudent financial planning for their future. It permits officers the support of financial planners who are familiar with the Company's plans, improving the accuracy of the financial planning and tax return preparation. Company officers may use Company aircraft for reasonable personal use, following a prescribed approval process. The Committee reviews the level of usage annually. Ability to use a Company plane for limited personal use saves time and provides additional security for executives. The value reportable to the Securities and Exchange Commission is detailed in the Summary Compensation Table. Executive Physical Examinations are available for all officers. The Committee considers this practice to be good corporate governance. Post-Employment Compensation: Severance Arrangements The Company does not have formal severance agreements with any of the Named Executive Officers. All aspects of severance for officers whose employment terminates other than by standard retirement are reviewed with and approved by the Committee. The Committee has established that any of the Named Executive Officers, if terminated other than for Cause, would receive twelve months Base Salary as severance, paid as salary continuation; pro-rated portion of Annual Bonus for the portion of the year prior to termination, payable at the normal time and using the same payout factors as for all other participants; vesting of any outstanding restricted stock, if the vesting date occurs during the period of severance. All of these elements would require a signed Release of Claims Agreement. Confidentiality and Non-Compete Agreements Each officer has signed an Agreement neither to disclose the Company's Confidential Information nor to accept employment with certain competitors during, and for twelve months subsequent to, the time the officer is employed by the Company. Change in Control Compensation Protection Provisions The Company's Change in Control Compensation Protection Plans require the occurrence of two events to trigger payments: (1) a Change in Control of the Corporation, and (2) termination or reduction in responsibilities and circumstances of the officer within two years of the Change in Control. In the event of a Change in Control, certain benefits would be provided to officers whose employment is terminated, or whose responsibilities and position are reduced, within two years of the event. Such officers would receive severance equal to one year's salary and Annual Bonus at a 1.0 Payout Factor. The Company would also provide for the full vesting of certain insurance and retirement benefits and the continuation for the one-year severance period of certain other employee benefits. All of the Named Executive Officers (the five officers listed in the compensation tables in this In addition to the severance provisions of the Change in Control Compensation Protection Plans, there are provisions within the Longer-term compensation plans that provide payment of outstanding awards in the event of a Change in Control, without requiring constructive termination of the officer. The Senior Executive Longer-Term Performance Plan would provide immediate pro-rated payouts for We hope this general discussion and the following tables and graphs help you understand the The Compensation Committee of the Board of Directors has reviewed and discussed the preceding Compensation Discussion and Analysis with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement for incorporation by reference into the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2007. CHAIR Name Annual Compensation Long Term Compensation Awards Payouts (1) (2) (3) Year Salary Bonus Other Restricted Stock Medium- All Other T. M. Solso 2005 $ 985,000 $ 1,970,000 $ 86,484 $ 0 0 $ 2,079,000 $ 118,489 Chairman of the Board and 2004 $ 972,750 $ 1,750,950 $ 0 0 $ 0 $ 113,248 Chief Executive Officer 2003 $ 950,500 $ 760,400 $ 0 30,800 $ 3,003,441 $ 70,387 F. J. Loughrey 2005 $ 701,667 $ 987,000 $ 55,481 $ 0 0 $ 715,000 $ 83,095 President and Chief 2004 $ 640,000 $ 729,600 $ 0 0 $ 0 $ 84,131 Operating Officer 2003 $ 605,000 $ 326,700 $ 0 10,600 $ 1,008,889 $ 52,435 T. Linebarger 2005 $ 520,000 $ 624,000 $ 0 0 $ 539,000 $ 17,384 Executive Vice President 2004 $ 480,000 $ 532,800 $ 0 0 $ 0 $ 13,640 President—Power Generation 2003 $ 455,000 $ 109,200 $ 0 7,900 $ 586,396 $ 8,201 J. S. Blackwell 2005 $ 477,500 $ 573,000 $ 0 0 $ 539,000 $ 51,012 Executive Vice President and 2004 $ 440,000 $ 475,200 $ 0 0 $ 0 $ 32,643 Chief Financial Officer 2003 $ 419,583 $ 201,400 $ 0 7,900 $ 617,127 $ 17,548 J. D. Kelly 2005 $ 425,000 $ 455,000 $ 0 0 $ 352,000 $ 67,441 Vice President 2004 $ 362,500 $ 344,375 $ 0 0 $ 0 $ 62,837 President—Engine Business 2003 $ 340,000 $ 153,000 $ 0 5,300 $ 426,000 $ 39,167 (3) The aggregate changes during 2007 in the actuarial present value of each Named Executive Officer's pension plans are as "Above-market" is defined as the amount of earnings that exceeded 120% of the (4) This column consists of the following: The Financial Counseling amounts include gross-ups to offset a portion of the taxable amount. Personal Use of Company Aircraft was calculated using an average indicated hourly cost of $2,326 which is the incremental cost incurred by the Company. Amount and Percent T. M. Solso 168,797 (1) F. J. Loughrey 79,388 * T. Linebarger 58,847 * J. S. Blackwell 38,260 * J. D. Kelly 25,485 * All directors and executive officers as a group, a total of 20 persons 586,633 1.32 % The following table Individual Grants Potential Realizable Options/SARs % of Total Exercise Expiration Annual Rates of Name Granted (#) Fiscal Year ($/share) Date 5% ($) 10% ($) T. M. Solso 0 N/A N/A N/A 0 0 F. J. Loughrey 0 N/A N/A N/A 0 0 T. Linebarger 0 N/A N/A N/A 0 0 J. S. Blackwell 0 N/A N/A N/A 0 0 J. D. Kelly 0 N/A N/A N/A 0 0 Value of Number of Number of Unexercised Securities Value Unexercised In-the-Money Underlying Realized Options/SARs at Options/SARs at Options/SARs ($) FY-end (#) FY-End ($) Name Exercised Exerciseable Exerciseable Unexercisable Exercisable Unexercisable T.M. Solso 30,800 $ 1,292,060 0 0 $0 $0 F.J. Loughrey 22,100 $ 804,160 0 0 $0 $0 T. Linebarger 12,700 $ 618,987 0 0 $0 $0 J.S. Blackwell 7,900 $ 252,405 0 0 $0 $0 J.D. Kelly 11,300 $ 242,795 0 0 $0 $0 Number of Shares, Period Until Estimated Future Payouts Under Period Until Name Rights(1) Payout Threshold Target Maximum Payout T. M. Solso 28,400 2005-2007 $ 202,700 $ 2,027,000 $ 4,054,000 2005-2006 F. J. Loughrey 11,370 2005-2007 $ 81,100 $ 811,000 $ 1,622,000 2005-2006 T. Linebarger 7,580 2005-2007 $ 54,100 $ 541,000 $ 1,082,000 2005-2006 J. S. Blackwell 7,580 2005-2007 $ 54,100 $ 541,000 $ 1,082,000 2005-2006 J. D. Kelly 5,680 2005-2007 $ 40,600 $ 406,000 $ 812,000 2005-2006 In addition to these grants of plan-based awards, each Named Executive Officer participates in the Annual (Annual Bonus) equals (Annual Base Salary) times (participation percentage assigned to each job) times (Payout Factor) The Payout Factors could range from zero to 2.0, in increments of .1. The following two tables are intended to enhance understanding of equity compensation that has been previously awarded and remains outstanding, including amounts realized on equity compensation during the last fiscal year as a result of the vesting or exercise of equity awards. The following three (3) tables disclose retirement benefits and other post-termination compensation for the Company's Named Executive Officers. The Cummins Inc. and Affiliates Pension Plan The Excess Benefit Plan The Supplemental Life Insurance and Deferred Income The The percentage is calculated as 2% of the The retirement benefit calculated by this formula is offset by the highest combined annuity available from Plan A and the Excess Benefit Plan, thus topping up the benefits available from those plans to total the target retirement benefit. Officers whose service and age total eighty (minimums of age 55 and 20 years service), or who were participants in the plan prior to 1997 and have at least thirty years of service, regardless of age would qualify for immediate unreduced commencement of Life Annuity benefits. Therefore, Messrs. Solso, Loughrey, and Kelly qualify for immediate commencement of unreduced benefits. Otherwise, after retirement or termination of employment, unreduced benefits may be commenced at age 60. Retired or terminated vested employees who do not qualify for unreduced benefits under the age and service conditions described in the previous paragraph may commence benefits as early as age 55, but the Life Annuity benefit would be reduced by .333% for each month the participant's age at commencement preceded 60. Vesting for the SERP benefit is 25% after five years service, increasing in 15% annual increments, with 100% vesting after 10 years service. The Life Annuity Benefit has a fifteen-year certain payment, with a 50% benefit for surviving spouse or domestic partner. The SERP benefit accrued for service prior to 2005 may be elected as a Lump Sum payment. Benefits accrued after 2005 are subject to the provisions of Internal Revenue Code 409(A), which preclude lump sum distributions of such benefits. The actuarial table Accelerated Formula for Executives Hired Mid-Career For some officers who joined the Company mid-career, including The Accelerated Formula provides a target benefit based on 4% for the first ten years and 2% for the next five years of Service, with a maximum of 50% of Five Year Average Pay after fifteen years of service. Eligibility for immediate commencement of unreduced benefits is achieved when Age and Service total seventy (minimums of Age 58 and 10 years of Service). Otherwise, for participants who are no longer employees of the Corporation, unreduced benefits may commence at Age 60, or as early as Age 55, but reduced .333% for each month age at commencement precedes Age 60. Full vesting occurs upon five years of service. Average Total 10 15 20 25 30+ $ 425,000 $ 85,000 $ 127,500 $ 170,000 $ 191,250 $ 212,500 $ 500,000 $ 100,000 $ 150,000 $ 200,000 $ 225,000 $ 250,000 $ 575,000 $ 115,000 $ 172,500 $ 230,000 $ 258,750 $ 287,500 $ 650,000 $ 130,000 $ 195,000 $ 260,000 $ 292,500 $ 325,000 $ 725,000 $ 145,000 $ 217,500 $ 290,000 $ 326,250 $ 362,500 $ 800,000 $ 160,000 $ 240,000 $ 320,000 $ 360,000 $ 400,000 $ 875,000 $ 175,000 $ 262,500 $ 350,000 $ 393,750 $ 437,500 $ 950,000 $ 190,000 $ 285,000 $ 380,000 $ 427,500 $ 475,000 $ 1,025,000 $ 205,000 $ 307,500 $ 410,000 $ 461,250 $ 512,500 $ 1,100,000 $ 220,000 $ 330,000 $ 440,000 $ 495,000 $ 550,000 $ 1,175,000 $ 235,000 $ 352,500 $ 470,000 $ 528,750 $ 587,500 $ 1,250,000 $ 250,000 $ 375,000 $ 500,000 $ 562,500 $ 625,000 $ 1,325,000 $ 265,000 $ 397,500 $ 530,000 $ 596,250 $ 662,500 $ 1,400,000 $ 280,000 $ 420,000 $ 560,000 $ 630,000 $ 700,000 $ 1,475,000 $ 295,000 $ 442,500 $ 590,000 $ 663,750 $ 737,500 $ 1,550,000 $ 310,000 $ 465,000 $ 620,000 $ 697,500 $ 775,000 $ 1,625,000 $ 325,000 $ 487,500 $ 650,000 $ 731,250 $ 812,500 $ 1,700,000 $ 340,000 $ 510,000 $ 680,000 $ 765,000 $ 850,000 $ 1,800,000 $ 360,000 $ 540,000 $ 720,000 $ 810,000 $ 900,000 $ 1,900,000 $ 380,000 $ 570,000 $ 760,000 $ 855,000 $ 950,000 $ 2,000,000 $ 400,000 $ 600,000 $ 800,000 $ 900,000 $ 1,000,000 "Change in NQ Deferred Compensation The Company's 1994 Deferred Compensation Plan permits deferral of up to 100% of Base Salary, Annual Bonus, and/or payments from the Senior Executive Longer-Term Performance Plan. Accounts are credited with earnings based on each participant's selection among three alternatives: Standard & Poor's 500 Index, Lehman Bond Index, or 10 Year Treasury Bill + 4%. The latter option was revised to be 10-Year Treasury Bill + 2% effective January 1, 2006. Crediting options may be changed annually. At the time of the election to defer, the participant chooses the time and Payments Upon a Qualified Termination Following a Change in Control of In the event of termination of employment within two years subsequent to a The Company Outstanding awards The 2003 Stock Incentive Plan provides that, in the event of a Change in Control, outstanding awards become immediately vested or exercisable. The value of supplemental and excess retirement All amounts of Definition of Change in Control: The occurrence of any of the would be required to be reported in response to Item 6(e) (or any successor provision) of Schedule 14A of Regulation 14A promulgated under the Exchange Act. The payments to each of the The following tables summarize the estimated payments to be made to Named Executive Officers under provisions of plans or established practice in the event of termination of employment including resignation, involuntary termination, involuntary termination for Cause, retirement, death and disability. Termination for Cause includes, but is not limited to: violation of Treatment of Others Policy, violation of the Code of Conduct, theft or other acts of dishonesty, willful destruction of Company property, refusal to obey a supervisor's reasonable instructions, conduct endangering the safety of employees or co-workers, falsification of Company documents, or violation of other Company rules or policies. We only report amounts where vesting requirements are waived and/or time of payment is accelerated, or benefits that are not generally available to our other exempt employees. Also, information is not repeated that is disclosed previously under the Pension Benefits Table, the Deferred Compensation Table, or the Outstanding Awards Table, except to the extent that the amounts payable to the The amounts shown assume the terminating event occurred on the last business day of None of the Named Executive Officers has an employment agreement. However, the Compensation Committee has established the practice of providing twelve months of severance for officers whose employment is terminated. It is Company policy not to provide severance in the event of termination for Cause. Payment of Annual Bonus Annual Bonus is payable for the portion of the year a participant is an employee, except in cases of termination for Cause. No amounts are shown in the tables for Annual Bonus since there would be no special treatment or acceleration of the payment to the Accelerated Vesting of Longer-term Grants As described elsewhere in this proxy statement, currently we provide annual Target Award grants of performance cash and performance shares. The Plan provides that if a participant's employment with the Company terminates during the first year of an Award Cycle, other than by reason of retirement, death or disability, the participant will not receive any payout for that Award Cycle. If a participant's employment terminates during subsequent years of an Award Cycle, the Compensation Committee, in its discretion, shall determine whether the Participant will receive a proportionate payout of any payment with respect to the Award Cycle based on the period of employment during the cycle. If a participant retires, dies or becomes disabled during an Award Cycle, the participant or such participant's estate, as the case may be, shall receive a proportionate share of any payment with respect to the Award Cycle based on the period of employment during the cycle, regardless of the length of time of such employment. 2006-2007 Award Cycle grants: since the entire Award Cycle had been completed at the time of the termination, all participants would be entitled to the payment at the normal time in February 2008. There would be no special acceleration; therefore, the amounts of these payments are not shown on the tables. 2007-2008 Award Cycle grants: Since the termination event is assumed to occur at the end of the first year of the Award Cycle, the Committee has the discretion to award one-half of the Target Award for the 2007-2008 Award Cycle. For purposes of this table, one-half of the Target Awards, assuming a Payout Factor of 1.0, is shown as payable under Retirement, Death, and Disability. In cases of retirement or termination without Cause, the Committee has the discretion to continue awards in effect, or to accelerate vesting of outstanding awards. After the death or disability of a participant, the Committee may in its sole discretion at any time (i) terminate restrictions regarding awards; (ii) accelerate any or all installments and rights; and (iii) instruct the Company to pay the total of any accelerated payments in a single sum to the participant, the participant's estate, beneficiaries or representative. Assumptions below are based on historic practice. 2005-2006 Award Cycle grants Target Awards of shares were earned based on Company performance during 2005-2006 and converted to restricted stock in February 2007. The shares would have become vested in February 2008, so it is assumed that the Committee would accelerate the vesting of these shares in all of the termination events, except voluntary termination and termination for Cause. 2006-2007 Award Cycle grants Performance shares would have been earned based on Company performance during 2006-2007 and converted to restricted stock in February 2008, and remained restricted until February 2009. No shares would be payable in the event of termination for Cause or voluntary termination. However the Committee would have the discretion to accelerate payment in the event of involuntary termination without Cause, retirement, disability or death. 2007-2008 Award Cycle grants Performance shares would become earned based on Company performance during 2007-2008 and converted to restricted stock in February 2009, and would remain restricted until March 2010. Since the shares were not earned, it is assumed no payments were accelerated. Messrs. Linebarger and Kelly received 10,000 shares of restricted stock in 2006 (40,000 shares on a split-adjusted basis). The first one-third of these grants would become vested in March 2008. It is assumed that these grants would be forfeited under all of the termination events shown on the tables. Executive Life Insurance Each of the Named Executive Officers participates in the Supplemental Life Insurance and Deferred Income Program, whereby Officers are eligible for life insurance equal to three times base salary. Since this is a program not participated in by non-Officer employees, the values of this incremental coverage is shown in the table. Set forth below is information as of March 24, 2008, regarding the beneficial ownership of Common Stock of the Company Cummins, with its subsidiaries and affiliates, is a global company with extensive operations in the U.S. and many foreign countries. It has thousands of employees with widespread authority to purchase goods and services. Because of these far-reaching activities, the Company encounters transactions and business arrangements with persons, businesses and other organizations in which one of its directors, executive officers or nominees for director, significant investors or their immediate families, may also be a director, executive officer, or have some other direct or indirect material interest. Such related-party transactions have the potential to create actual or perceived conflicts of interest. As a result, the Audit Committee of the Board of Directors has established and the Board has approved a written policy and procedures for review, approval or ratification of related-party transactions or proposed transactions where the amount involved in any fiscal year exceeds or will exceed $120,000. These require that in deciding whether to approve such a related-party transaction involving a director, director nominee, executive officer, significant investor or their immediate family members, the Audit Committee must consider, among other factors: Largest Amount of J.C. Wall $ 297,850 $ 0 To receive Audit Committee approval a related party transaction must be on terms that are fair and reasonable to Based on its review of responses to the director questionnaires submitted in connection with determining director independence, information provided by management, and other information otherwise known to the Company, it believes there were no transactions during fiscal year 2007 in which the Company was a party in which the amount involved exceeded or will exceed $120,000, and in which any director, director nominee, executive officer, holder of more than five percent of the Company's Common Stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest. Therefore, no transactions were required to be reviewed, approved or ratified under the policy and procedures and disclosed in this proxy statement in accordance with rules of the Securities and Exchange Commission. Section 16(a) of the Securities Exchange Act of 1934 requires the The Audit Committee of the All services rendered to the Company by PwC are permissible under applicable laws and regulations, and are pre-approved by the Audit These services are actively monitored (both spending level and work content) by the Audit Committee to maintain the appropriate objectivity and independence in Audit and Non-Audit Fees The following table presents fees for professional audit services rendered by PwC for the audit of the 2004 2005 Audit fees:(1) 9.2 6.9 Audit related fees: 0.4 0 Tax fees: 0.3 0.4 Subtotal 9.9 7.3 All other fees: 0.3 0.1 Total 10.2 7.4 audits. Audit Committee Pre-Approval Policy The Sarbanes-Oxley Act of 2002 and rules of the Securities and Exchange Commission prohibit the Company's independent accountant from providing certain types of non-audit services to the Company. They also require that all audit, review or attest engagements required under the securities laws and permitted non-audit services provided to the Company by its independent accountant be pre-approved by the Audit Committee or one of its members to whom the Audit Committee has delegated authority. Under Company policy and procedures, when considering whether to approve non-audit services to be provided by the Company's independent accountant, the Audit Committee must consider whether the provision of the service would adversely affect the independence of the independent accountant. Specifically, the Audit Committee must consider whether the provision of the service would (i) place the accountant in the position of auditing his or her own work; (ii) result in the accountant acting as management or an employee of the company; or (iii) place the accountant in the position of being an advocate for the Company. Any proposed non-audit service that the Audit Committee determines would adversely affect the independence of the independent accountant shall not be approved. The Audit Committee is solely responsible for pre-approving all audit and non-audit services. The Audit Committee has delegated to its Chairman authority to pre-approve audit and permitted non-audit services to be provided by the Company's independent accountant, provided that such services are permissible under the policy and procedures and do not exceed $100,000 in the aggregate. Decisions of the Chairman must be reported to the full Audit Committee at its next scheduled meeting, and documented in a format required by the policy. The Board of Directors recommends that shareholders voteFOR this The role of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities as they relate to the The Committee fulfills its responsibilities through periodic meetings with the Throughout the year the Audit Committee monitors matters related to the independence of PricewaterhouseCoopers, the The Committee reviewed with both the control over financial reporting and the independent auditor has the responsibility for the examinations thereof. The Committee discussed and reviewed with the independent auditors all matters required by auditing standards generally accepted in the United States of America, including those described in Statement on Auditing Standards No. 61, as amended, Based on the above-mentioned reviews and discussions with management, internal audit and the independent auditors, the Committee recommended to the Board of Directors that the On January 2, 2008, additional shares of Common Stock were distributed to shareholders of record as of December 21, 2007 pursuant to a two-for-one Common Stock split in the form of a stock dividend. As a result of this increase in the number of shares of Common Stock issued and outstanding and for other reasons, the Board of Directors has determined that it is desirable to increase the number of shares of Common Stock that will be authorized for issuance under the Company's Restated Articles of Incorporation. Accordingly, the Board has proposed to amend Section 4.1 of Article IV of the Restated Articles of Incorporation, as amended, the effect of which will be to increase the number authorized from 300,000,000 to 500,000,000. No other changes are proposed to be made to the Articles with respect to any other class of securities authorized for issuance under the Articles. Under Indiana law, shareholders must approve an amendment to the Company's Restated Articles of Incorporation. If the proposed amendment is approved, Section 4.1 of Article IV thereof will be amended to read in its entirety as follows: "The total number of shares which the Corporation has authority to issue shall be 502,000,000 shares, consisting of 500,000,000 shares of common stock ("Common Stock"), 1,000,000 shares of preference stock ("Preference Stock") and 1,000,000 shares of preferred stock ("Preferred Stock"). The shares of Common Stock have a par value of $2.50 per share. The shares of Preference and Preferred Stock do not have any par or stated value, except that, solely for the purpose of any statute or regulation imposing any tax or fee based upon the capitalization of the Corporation, each of the Corporation's shares of Preference Stock and Preferred Stock shall be deemed to have a par value of $1.00 per share." If approved, this amendment will become effective upon the filing with the Secretary of State of Indiana of Articles of Amendment of the Articles of Incorporation. The Company would make such a filing promptly after the Annual Meeting. The Board of Directors believes that the proposed increase in the number of shares of Common Stock authorized for issuance is in the best interests of the Company and its shareholders. An increase in the number of authorized shares will give the Board of Directors the authority to issue shares to implement future capital structure and other transactions which are, in the best judgment of the Board, advantageous to the Company and its shareholders, regaining the capacity and flexibility it had for such transactions prior to the two-for-one stock split. As of March 24, 2008, there were 203,215,953 shares of Common Stock outstanding and 18,321,572 shares issued and held by the Company as treasury shares, aggregating 221,537,525 shares issued. No shares of Preference or Preferred Stock are currently issued and outstanding. The Board of Directors recommends a voteFOR the proposal to amend the Restated Articles of Incorporation to increase the number of authorized shares of Common Stock. This Item will be approved if the number of votes cast in favor of the Item exceeds the number of votes cast against the Item. The following Shareholder Proposal has been submitted by Domini Social Investments, 536 Broadway, 7th Floor, New York, NY 10012-3915 ("Domini"), SEIU Master Trust, 11 Dupont Circle, N.W., Ste 900, Washington, D.C. 20036 ("SEIU"); and Harrington Investments, 1001 2nd Street, Suite 325, Napa, CA 94559 ("Harrington"), each of which is a beneficial owner of the requisite number of shares of Common Stock to make the proposal. "WHEREAS: Cummins' reputation as a socially responsible company is a valuable asset to the Company. Cummins has been named to the "Best Corporate Citizen" list by CRO Magazine (formerlyBusiness Ethics Magazine) for eight consecutive years. RESOLVED: Shareholders request the Board of Directors to: SUPPORTING STATEMENT Proponents recommend that the requested report be based on a means of assessment determined by the Board, subject to independent verification, and that it include a discussion of any deficiencies that could result in non-compliance with ILO Conventions 87, 98 and 135, described briefly below: The Company recommends aNO vote on the proposal. The Company is committed to fair and equitable treatment of all employees and other stakeholders. This proposal is based on information that is not current and calls for control measures that already are in place, and are effective and transparent. We support the workplace human rights principles and standards advocated by the proponent, and our existing Codes of Conduct, policies and procedures effectively address these issues. We stand by our workers' rights record and believe our Code of Business Conduct already embodies the intent of the ILO standards being proposed by the proponent. For nearly 90 years, we have made it a priority to ensure that our employees have a safe and healthy work environment. Our Code of Business Conduct articulates this commitment and helps ensure that our standards are applied evenly and consistently throughout the Company. We conduct a regular review of our Code given the ever-changing nature of the Company and the workplace. Our Code was recently revised in January 2008, and outlines our commitment to ethical behavior and serves as a guide for the behavior of every one of our employees. It can be easily accessed by our workers on our intranet and by the public from the home page of our Web site, www.cummins.com. The Code of Business Conduct includes many provisions that specifically protect the rights of workers and are in alignment with ILO Conventions 87, 98 and 135. These include the following: The proposal references a "report" written last year about workers at Cummins distributors. The International Brotherhood of Teamsters—which represents no Cummins Inc. employees and represents only about 300 of the approximately 8,000 workers of Cummins' North American distributors—paid Mr. Compa to write this report, which he completed without contacting Cummins to check the facts or obtain the Company's response. Cummins investigated the allegations in this report and found them to be without merit. The Company's investigation also confirmed that our distributors had not violated any laws or Company policies. Today there are no allegations of wrongdoing in the Cummins distribution network, employee- ratified collective bargaining agreements are in effect at all union locations and no union or employee group anywhere in the world has echoed the allegations made in the Teamsters-funded "report." Nonetheless, we are taking additional steps to ensure that our joint venture entities and distributors treat their employees in a fair and equitable fashion. By the end of the year, we will have completed an audit of our joint venture partners, including our North American distributors, to ensure that they have either adopted our Code of Business Conduct or a have a substantially similar code in place that embodies the same principles. Since 2005, we have had a Supplier Code of Conduct in place that requires our suppliers to follow all local laws (including laws protecting freedom of association), refrain from using forced or child labor and provide a safe workplace where employees are treated with dignity and respect. We believe that adopting a Supplier Code of Conduct was a significant step towards protecting workers' rights because we can now reach beyond the limits of the Company and help protect workers' rights throughout the supply chain. We have introduced our Supplier Code to over 95% of our supply base and we will continue this rollout in 2008. We also are developing processes to confirm compliance with the Supplier Code and currently are updating the Supplier Code to better align it with the Company Code of Business Conduct. The Supplier Code can be found in the "Global Citizenship" section of Cummins web site. The Company Code of Business Conduct and Supplier Code of Conduct, while important statements of behavioral norms, are meaningless unless they are enforced appropriately and discussed openly. We believe that the Codes are only important if people know about them, so we have placed both Codes on our website to allow our employees and the public to easily access them. We annually publish a Sustainability Report that includes a discussion of the Codes and the steps we have taken to comply with them, and this year we have enhanced our discussion regarding the Codes and our training of employees to show how we thoughtfully address issues of concern. We have taken other steps to ensure that both Codes are followed: Information about these processes can be found in our most current Sustainability Report, available online at the home page and the "Investors and Media" section of www.cummins.com. The proponents' proposal would be difficult, if not impossible, to implement and enforce and would likely be a drain on Company resources. The ILO standards were developed as international standards on which countries could establish workers' rights laws. They were never intended to be directly adopted by companies. We believe that the proposal is duplicative of the many steps that the Company has already taken to ensure that its employees' rights are protected, and adopting this proposal will impose unnecessary costs on the Company. We stand by our record in regards to workers' rights and believe we have adequately addressed the matters raised in the proposal. This proposal, while well-intentioned, is burdensome and unnecessary in light of our proven commitment to our employees and other stakeholders. The Board of Directors, therefore, recommends a voteAGAINST the proposal. The proposal will be adopted if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal. An abstention will have the same effect as a vote against the proposal. Broker non-votes will have no effect on the proposal. The Board of Directors does not know of any business to be presented for action at the meeting other than that set forth in Shareholders may submit proposals to be considered for shareholder action at the If a shareholder desires to bring proper business before an annual meeting of shareholders which is not the subject of a proposal timely submitted for inclusion in the The cost of this proxy solicitation will be borne by the Company. Morrow & Co., April Mr. Solso was elected Chairman of the Board and Chief Executive Officer of the Company in 2000 after serving as its President since 1995, Chief Operating Officer since 1994 and Executive Vice President—Operations from 1992 through 1994. From 1988 to 1992 he was Vice President and General Manager—Engine Business after serving in various other executive positions with the Company. Mr. Solso received a B.A. from DePauw University in 1969 and an M.B.A. degree from Harvard University in 1971. He is a Director of Ball Corp., Inc. CUMMINS ANNUAL SHAREHOLDER MEETING CUMMINS INC. ANNUAL MEETING OF SHAREHOLDERS Tuesday, May 11:00 a.m. Eastern Daylight Savings Time Columbus, Indiana If you consented to access your proxy information electronically, you may view it by going to the Cummins Inc. website. You can get there by typing in the following address: If you would like to access the proxy materials electronically next year, go to the following Consent site address: Cummins Inc. proxy This proxy is solicited by the Board of Directors for use at the Annual Meeting on May If no choice is specified, the proxy will be voted “FOR” Items 1 through 11 and By signing the proxy, you revoke all prior proxies and appoint Robert J. This card also constitutes voting instructions to the trustees or administrators, as applicable, of the Cummins Inc. and Affiliates Retirement and Savings Plans to vote shares attributable to accounts the undersigned may hold under such plans as indicated on the reverse of this card. If no voting instructions are provided, shares held in these accounts will be voted in the same manner and proportion as shares with respect to which valid voting instructions were received. See reverse for voting instructions. There are three ways to vote your Proxy Your telephone or Internet vote authorizes the Named Proxies to vote yourshares in the same manner as if you marked, signed and returned your proxycard. COMPANY # VOTE BY PHONE — TOLL FREE — 1-800-560-1965 — QUICK VOTE BY INTERNET — VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we’ve provided or return it to Cummins Inc., c/o Shareowner If you vote by Phone or Internet, please do not mail your Proxy Card The Board of Directors Recommends a Vote FOR Items 1 through 11 and AGAINST Item 12. Election of directors: FOR AGAINST ABSTAIN 1. Robert J. Darnall o o o 2. Robert K. Herdman o o o 3. Alexis M. Herman o o o 4. F. Joseph Loughrey o o o FOR AGAINST ABSTAIN 5. William I. Miller o o o 6. Georgia R. Nelson o o o 7. Theodore M. Solso o o o 8. Carl Ware o o o 9. J. Lawrence Wilson o o o 10. Proposal to ratify the appointment of PricewaterhouseCoopers LLP as o FOR o AGAINST o ABSTAIN auditors for the year 2008. 11. Proposal to amend Restated Articles of Incorporation to increase o FOR o AGAINST o ABSTAIN authorized shares. 12. Proposal to adopt International Labor Organization standards. o FOR o AGAINST o ABSTAIN 13. To transact any other business that may properly come before the meeting or any adjournment thereof, other than with respect to shares held in the Cummins Inc. and Affiliates Retirement and Savings Plans. THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR ITEMS 1 THROUGH 11 AND AGAINST ITEM 12. Address Change? Mark Box o Indicate changes below: Date Signature(s) in Box Please sign exactly as your name(s) appear on Proxy. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. The Board of Directors Recommends a Vote FOR Items 1 and 2. 1. ELECTION OF DIRECTORS: 01 Robert J. Darnall 06 Georgia R. Nelson ¨ Vote FOR ¨ Vote WITHHOLD 02 John M. Deutch 07 Theodore M. Solso all nominees from all nominees 03 Alexis M. Herman 08 Carl Ware (except as marked) 04 F. Joseph Loughrey 09 J. Lawrence Wilson 05 William I. Miller (Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) 2. Proposal to ratify the appointment of PricewaterhouseCoopers LLP as auditors for the year 2006. ¨ For o Against o Abstain 3. To transact any other business that may properly come before the meeting or any adjournment thereof, other than with respect to shares held in the Cummins Inc. and Affiliates Retirement and Savings Plans. THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, WILL BE VOTED FOR ITEMS 1 AND 2. Address Change? Mark box o Indicate changes below: Date __________________________ Signature(s) in Box Please sign exactly as your name(s) appear on Proxy. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy.

PROXY STATEMENT“Company”"Company" or “Cummins”"Cummins") of proxies to be voted at the Annual Meeting of Shareholders to be held on Tuesday, May 9, 2006,13, 2008, and at any adjournment thereof (the “Annual Meeting”"Annual Meeting"). This proxy statement, together with the enclosed proxy, is first being mailed to the shareholders of the Company on or about April 7, 2006.4, 2008.Company’sCompany's Common Stock of record at the close of business on March 20, 200624, 2008 are entitled to vote at the Annual Meeting. On that date there were issued and outstanding 44,529,112203,215,953 shares of Common Stock, each of which is entitled to one vote.itshis vote in person instead of by proxy, thereby canceling the previously executed proxy.20052007, on an adjusted basis reflecting a subsequent two-for-one split on January 2, 2008, (i) the number of shares beneficially owned by such shareholder(s) and the nature of such beneficial ownership and (ii) the percentage of the entire class of Common Stock so beneficially owned:

of Beneficial

Ownership

225 Franklin Street

Boston, MA 02110

45 Freemont Street

San Francisco, CA 94105

90 Hudson St.

Jersey City, NJ 07302

82 Devonshire Street

Boston, MA 02109

1 N. Wacker Drive, Suite 4000

Chicago, IL 60606

333 South Hope Street

Los Angeles, CA 90071 Amount & Nature of Beneficial Ownership Percent of Class State Street Bank and Trust Company

One Lincoln Street

Boston, MA 02111 21,059,718 (1) 10.36 %

FMR LLC.

82 Devonshire Street

Boston, MA 02109

17,823,056

(2)

8.77

%13, 200612, 2008 disclosing beneficial ownership by State Street Bank and Trust Company. State Street discloses in its 13G that it has shared investment power for all of the shares, shared voting power for 4,335,16811,599,954 shares, and sole voting power for 1,983,6389,459,764 shares. State Street is the Trustee of certain employee benefit plans sponsored by the Company which are subject to ERISA. Shares of Common Stock are held in trust for the benefit of employees in the plans. As of December 31, 2005,2007, the Trustee held 4,335,16811,599,954 shares of Common Stock on behalf of the plans, some of which had not been allocated to plan participants. The plan Trustee votes unallocated shares and shares allocated to participants’participants' accounts as directed by participants. Shares of Common Stock held by the Trustee on behalf of the plans as to which participants have made no timely voting directions are voted by the plan Trustee in the same proportions as shares for which directions are received (subject to the Trustee’sTrustee's responsibilities under Section 404 of ERISA). The source of this information is a Schedule 13G dated January 31, 2006 disclosing beneficial ownership by Barclays Global Investors N/A. Barclays states in its 13G that it has sole investment power for all of the shares, sole voting power for 4,302,979 shares, and no shared investment or voting power.(3)1, 200613, 2008 disclosing beneficial ownership by Lord, Abbett. TheFMR LLC and its related companies. FMR and its related companies state in the 13G states that Lord, Abbett has sole voting and investment powers with respect to all of the shares.(4) The source of this information is a Schedule 13G/A dated February 14, 2006 disclosing beneficial ownership by FMR. FMR states in its 13G/A that it hasthey have sole investment power for all of the shares and sole voting power for 637,781 shares, and no shared investment or voting power.(5) The source of this information is a Schedule 13G dated February 10, 2006 disclosing beneficial ownership by LVS Asset Management. LVS states in its 13G that it has sole investment power for 2,391,032 of the shares, sole voting power for 1,715,832 shares, and no shared investment or voting power.(6) The source of this information is a Schedule 13G dated February 6, 2006 disclosing beneficial ownership by Capital Research and Management Company. The number of shares reported includes 713,190 shares resulting from the assumed conversion of 678,000 shares of 7% Cummins Capital Trust I Convertible Preferred. The 13G states that Capital has sole investment power for all of the shares, sole voting power for 500,000 shares, and no shared investment or voting power.3

ELECTION OF DIRECTORS

(Items 1 through 9 on the Proxy Card)It is intended that votes will Nine directors are to be cast pursuantelected at the Annual Meeting to hold office until the accompanying proxy for the electionnext annual meeting of the nine nominees listed in the following table, all of whom are presently directors of the Company. All directors will serve for the ensuing yearshareholders and until their respective successors are elected and qualified. A shareholder may withhold authority from such shareholder’sThe accompanying proxy to vote for the election of any or allwill be voted in favor of the nominees.nominees named below to serve as directors unless the shareholder indicates to the contrary on the proxy. All of the nominees are current directors.has no reason to believeexpects that anyeach of the nominees will be available for election, but if any of them is unable to serve if elected. If, for any reason, one or more of such persons should be unable to serve, it is intended that votesat the time the election occurs, the proxy will be castvoted for a substitutethe election of another nominee or nomineesto be designated by the Board of Directors, unless the Board of Directors decides to reduce the number of directors.2645 through 2847 of this proxy statement.Proxy Statement.

Elected a

Director

Nature of Beneficial

Ownership as of

March 20, 2006(1)

of

Class

Held as of

March 20,

2006(2)Name and Occupation Age First Year Elected a Director Amount and Nature of Beneficial Ownership as of March 24, 2008

(1) Percent of Class Stock Units Held as of March 24, 2008

(2) Total Robert J. Darnall

Retired Chairman and Chief Executive Officer of Inland Steel Industries, basic steel manufacturer, processor and distributor 70 1989 37,013 * 13,793 50,806 Robert K. Herdman

Managing Director of Kalorama Partners LLC, independent consulting firm 59 2008 0 * 0 0 Alexis M. Herman

Chairman and Chief Executive Officer of New Ventures, independent consulting firm 60 2001 22,769 * 0 22,769 F. Joseph Loughrey

President and Chief Operating Officer of Cummins 58 2005 392,922 * 0 392,922 William I. Miller

Chairman and Chief Executive Officer of Irwin Financial Corporation, financial services company 51 1989 85,174 * 3,436 88,610 Georgia R. Nelson

President and Chief Executive Officer of PTI Resources, LLC, independent consulting firm 58 2004 12,213 * 0 12,213 Theodore M. Solso

Chairman and Chief Executive Officer of Cummins 61 1994 642,863 (3) * 0 642,863 Carl Ware

Retired Executive Vice President, Public Affairs and Administration, The Coca-Cola Company 64 2004 10,220 * 0 10,220 J. Lawrence Wilson